Anti-Dilution Provisions

Anti-dilution provision is designed to protect holders of convertible securities from future issuance at prices lower than paid by them. These provisions can have significant economic consequences for during-what every founder hopes will never happen- a Down Round.

Even the experienced Legal and Finance professionals, often poorly understand what is behind the complicated antidilution formula. As a result, they tend to rely on precedents and templates; without examining the consequences of provisions.

Further, the understanding of this frameworks opens up new possibilities in modifying; what is a boiler plate, standard formulae, to something that addresses specific business scenario and not just offer protection to Investors but also to Funders (e.g. Claw back incentive).

This document will give an overview of how to build the cap table scenarios using “solve the puzzle” approach, instead of prescribing the algebraic formula often found in the subscription agreement. Of course, the results from both the methods are identical but the puzzle approach gives flexibility to model different scenarios.

What is Dilution?

Dilution is a reduction in; either Ownership (shareholding %) or Value. ($) experienced by, in this case, the investor. Ownership dilution happens when a new investor joins the cap table. This is natural and expected as the company issues additional ownership shares to new investors. However, Value dilution is an adverse event for the Existing Investor since the new investment is being made at a price lower than paid by him.

Types of anti-dilution protection

- Ownership Anti-Dilution – In this type of protection, protected Investor’s expectation is : “I want my Ownership % to remain unchanged. So, additional shares be allotted to me to compensate for any dilution in my current ownership % in the Down round”.

- Full Ratchet Anti-Dilution – Here Investor expectation is : “I want my Value ($) of Investment unchanged So, additional shares be allotted to me so that my value of the investment remains intact”.

- Weighted Average Anti-Dilution – It’s a middle path and here the expectation is : “Let us average (weighted) out the valuation of this and the earlier round. Then, allot me additional shares as if my investment was made at the new average valuation”.

Irrespective of the type, all protections are invariably offered from out of Founders ownership share.

Cap Table Modeling

Example : XYZ Private Limited raised the first round of investment of 1,00,00,000 at a pre-Money valuation of 4,00,00,000; giving away 20% ownership to the investor. Subsequently, the company must raise additional capital for sustenance. A new investor agreed to sign the cheque, again for 1,00,00,000, but seeks 25% ownership. These new terms set the company’s pre-money valuation at 3,00,00,000; lower than the first round. This is the Down Round, and it will trigger anti-dilution provisions for the Existing Investor.

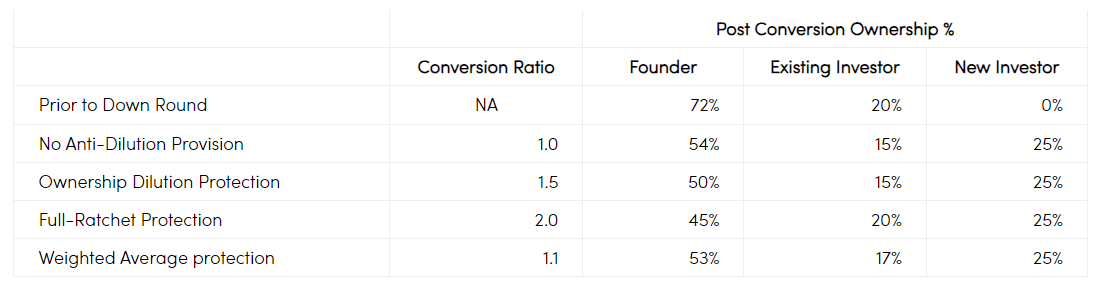

Once types of protection are understood, it is easy to model Cap-table and analyze the impact using “Puzzle” solution approach that avoids using the complex, non-intuitive algebraic expression. This approach is detailed under Annexure -1 and below is the summary of results showing dilution to Founder’s ownership across different types of protection.

| Post Conversion Ownership % | ||||

| Conversion Ratio | Founder | Existing Investor | New Investor | |

| Prior to Down Round | NA | 72% | 20% | 0% |

| No Anti-Dilution Provision | 1.0 | 54% | 15% | 25% |

| Ownership Dilution Protection | 1.5 | 50% | 15% | 25% |

| Full-Ratchet Protection | 2.0 | 45% | 20% | 25% |

| Weighted Average protection | 1.1 | 53% | 17% | 25% |

Takeaways

While dilution of Founders ownership from 72% to 54% is due to lower valuation in the down round, there is an additional dilution to 45% in Full Ratchet protection, to 50% in Ownership protection, and to more modest 53% in Weighted Average method (most adopted method during startup funding).

Founders should be well appraised of anti-dilution protection mechanism and impact of it on their ownership percentage in case of down rounds in future.

It is advisable to minimize the quantum of fund raise during the down round to adjust weighted average valuation base.

Most importantly, not to get caught in the frenzy of higher valuation, particularly at the early stage.

If valuation is not sustainable, the anti-dilution provisions will have an adverse impact on ownership %, which can hamper future fund raises.

Anti-Dilution framework can be tweaked to additionally consider a Performance-based incentive program for Founders including Claw-back of ownership shares.

Annexure -1

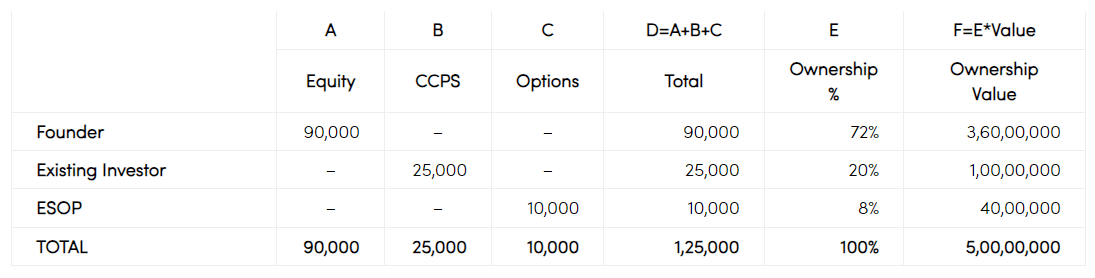

- Cap & Value prior to the Down round

| A | B | C | D=A+B+C | E | F=E*Value | |

| Equity | CCPS | Options | Total | Ownership % |

Ownership Value | |

| Founder | 90,000 | – | – | 90,000 | 72% | 3,60,00,000 |

| Existing Investor | – | 25,000 | – | 25,000 | 20% | 1,00,00,000 |

| ESOP | – | – | 10,000 | 10,000 | 8% | 40,00,000 |

| TOTAL | 90,000 | 25,000 | 10,000 | 1,25,000 | 100% | 5,00,00,000 |

- Cap & Value prior to the Down round

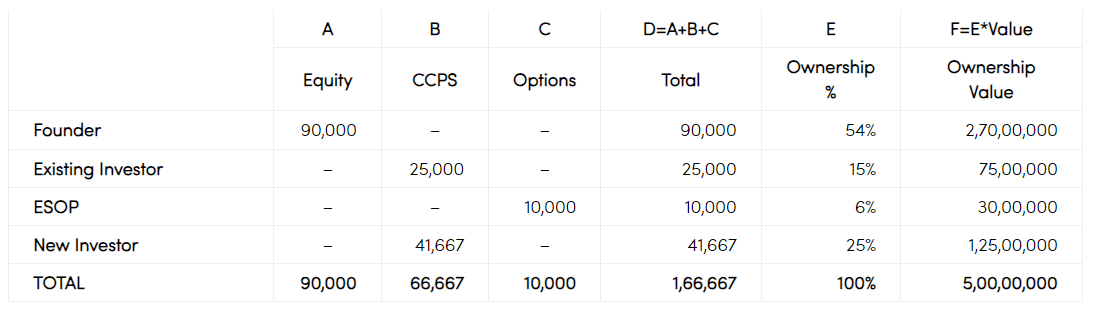

- Cap & Value after Down round (no Anti-dilution provision)

| A | B | C | D=A+B+C | E | F=E*Value | |

| Equity | CCPS | Options | Total | Ownership % |

Ownership Value | |

| Founder | 90,000 | – | – | 90,000 | 54% | 2,70,00,000 |

| Existing Investor | – | 25,000 | – | 25,000 | 15% | 75,00,000 |

| ESOP | – | – | 10,000 | 10,000 | 6% | 30,00,000 |

| New Investor | – | 41,667 | – | 41,667 | 25% | 1,25,00,000 |

| TOTAL | 90,000 | 66,667 | 10,000 | 1,66,667 | 100% | 5,00,00,000 |

- Cap & Value after Down round (no Anti-dilution provision)

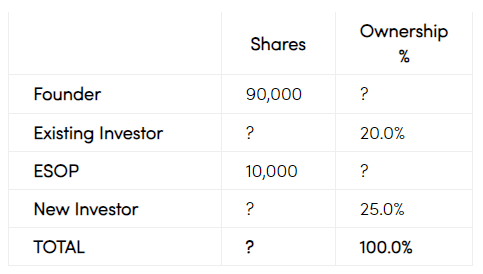

In the first scenario, Existing Investor has negotiated Ownership Anti-Dilution protection prompting a requirement to issue additional shares, free of cost, to pare back the ownership at 20%. The “puzzle” with knows facts and unknowns (indicated as?) can be constructed as below. Founder’s and ESOP number of shares are known fact and not changing. Also, it is known that the new Investor must own 25%.

|

|

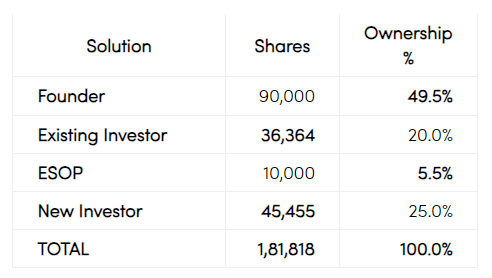

Since New Investor has 25% ownership, Value accredited to it will be 1,00,00,000. Existing Investor to has 1,00,00,000 of Value. So, its % ownership will be 25%. Balance 50% ownership is with Founder and ESOP Pool. Thant makes total number of shares to 2,00,000. Once the total number of shares is known, we can easily find the ownership % for all.

- Cap & Value after Down round (Ownership Anti-dilution provision)

| A | B | C | D=A+B+C | E | F=E*Value | |

| Equity | CCPS | Options | Total | Ownership % |

Ownership Value | |

| Founder | 90,000 | – | – | 90,000 | 50% | 1,98,00,000 |

| Existing Investor | 36,364 | – | – | 36,364 | 20% | 80,00,000 |

| ESOP | – | – | 10,000 | 10,000 | 6% | 22,00,000 |

| New Investor | – | 45,455 | – | 45,455 | 25% | 1,00,00,000 |

| TOTAL | 1,26,364 | 45,455 | 10,000 | 1,81,818 | 100% | 4,00,00,000 |

- Cap & Value after Down round (Ownership Anti-dilution provision)

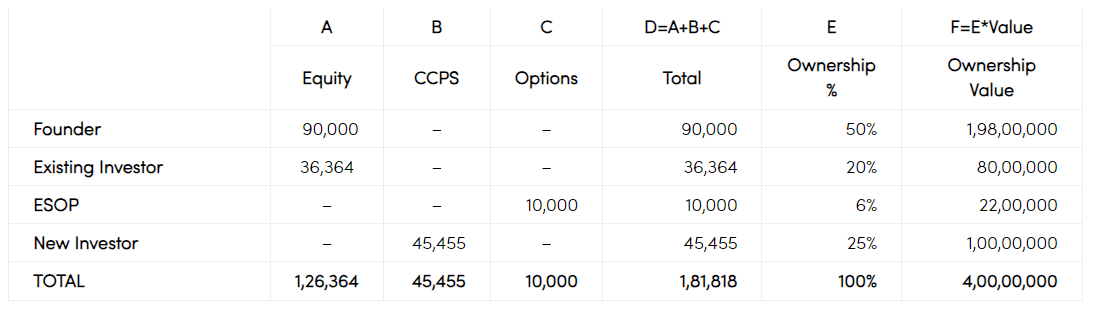

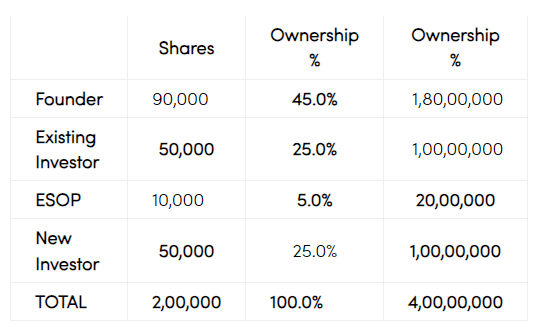

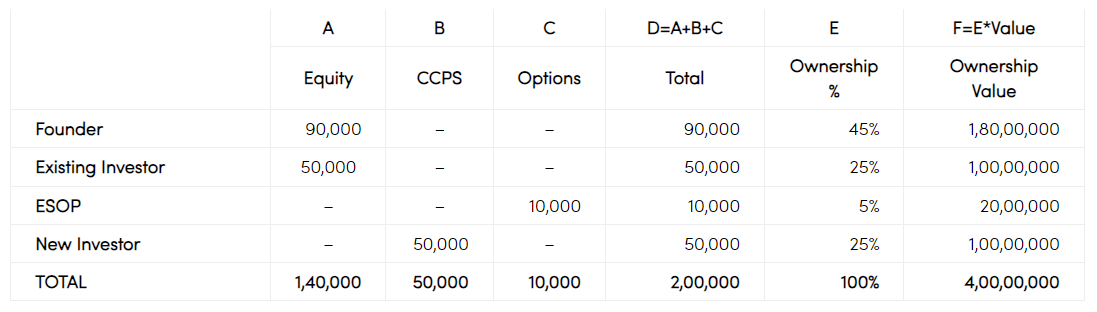

In the Second scenario, Existing Investor has negotiated Full-Ratchet Anti-Dilution protection prompting a requirement to issue as many additional shares, free of cost, as to pare back Ownership value to 1,00,00,000. The modeling of this again is easy by solving the puzzle.

|

|

Since New Investor has 25% ownership, Value accredited to it will be 1,00,00,000. Existing Investor to has 1,00,00,000 of Value. So, its % ownership will be 25%. Balance 50% ownership is with Founder and ESOP Pool. Thant makes total number of shares to 2,00,000. Once the total number of shares is known, we can easily find the ownership % for all.

- Cap & Value after Down round (Full-Ratchet Anti-dilution provision)

| A | B | C | D=A+B+C | E | F=E*Value | |

| Equity | CCPS | Options | Total | Ownership % |

Ownership Value | |

| Founder | 90,000 | – | – | 90,000 | 45% | 1,80,00,000 |

| Existing Investor | 50,000 | – | – | 50,000 | 25% | 1,00,00,000 |

| ESOP | – | – | 10,000 | 10,000 | 5% | 20,00,000 |

| New Investor | – | 50,000 | – | 50,000 | 25% | 1,00,00,000 |

| TOTAL | 1,40,000 | 50,000 | 10,000 | 2,00,000 | 100% | 4,00,00,000 |

- Cap & Value after Down round (Full-Ratchet Anti-dilution provision)

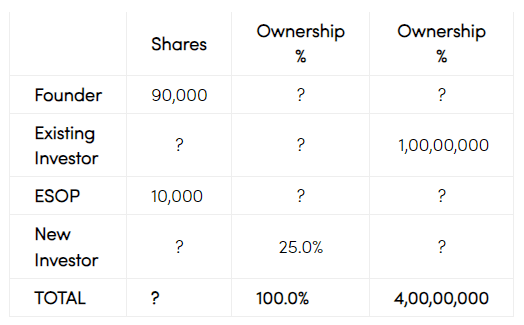

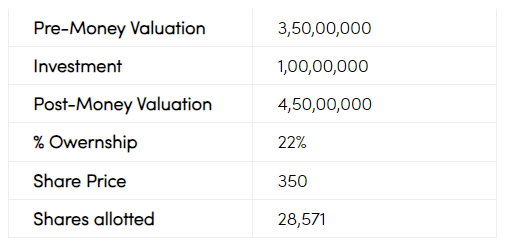

In the Third scenario, Existing Investor has negotiated Weighted Average Anti-Dilution protection prompting a requirement to issue as many additional shares, free of cost, as if its original investment was made at the weighted average valuation of this and earlier round. The average valuation in this case will be 3,50,00,000. So, we must retrospectively construct the first round as follows before including the New Investor.

|

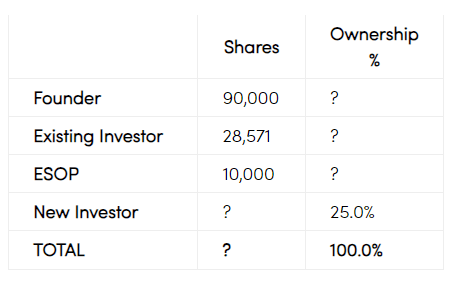

With the inclusion of new investor, the resulting Cap Table and Ownership Value can be derived from solving this puzzle.

|

|

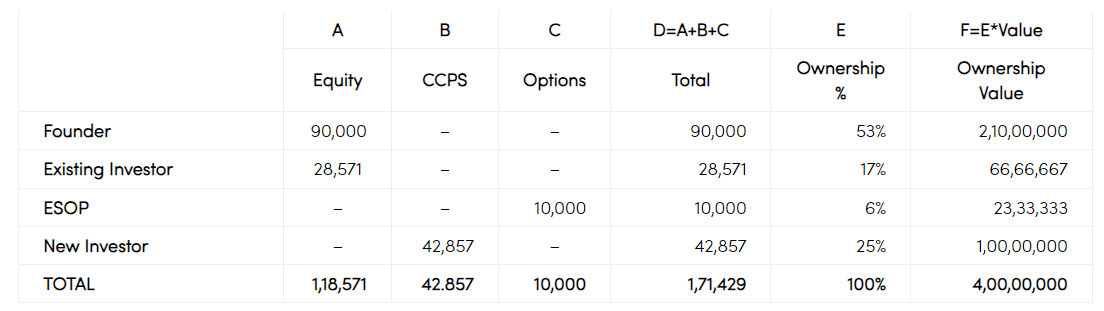

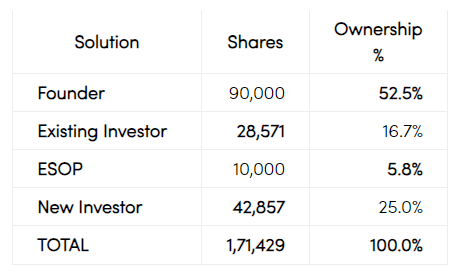

- Cap & Value after Down round (Weighed Average Anti-dilution provision)

| A | B | C | D=A+B+C | E | F=E*Value | |

| Equity | CCPS | Options | Total | Ownership % |

Ownership Value | |

| Founder | 90,000 | – | – | 90,000 | 53% | 2,10,00,000 |

| Existing Investor | 28,571 | – | – | 28,571 | 17% | 66,66,667 |

| ESOP | – | – | 10,000 | 10,000 | 6% | 23,33,333 |

| New Investor | – | 42,857 | – | 42,857 | 25% | 1,00,00,000 |

| TOTAL | 1,18,571 | 42.857 | 10,000 | 1,71,429 | 100% | 4,00,00,000 |

- Cap & Value after Down round (Weighed Average Anti-dilution provision)